CLAIMING CAR EXPENSES FOR WORK RELATED TRAVEL

If you use your vehicle for work purposes you may be eligible to claim a percentage of costs such as running costs like fuel, registration, insurance and services, and ownerships costs of finance interest and depreciation however to do this you need to complete a valid car logbook.

The logbook must cover at least 12 continuous weeks, which once completed will last for five years (unless you have significant business/work changes which will affect the amount you use the car for business/work purposes). If you are using the logbook method for two or more cars, the logbook for each car must cover the same period. If you have not kept a log book for the past five years you must do a new logbook in this financial year.

If you do not have a valid car logbook less than five years old you cannot use the ‘logbook’ method. You must use an alternative car claim method, which usually results in a reduced tax deduction.

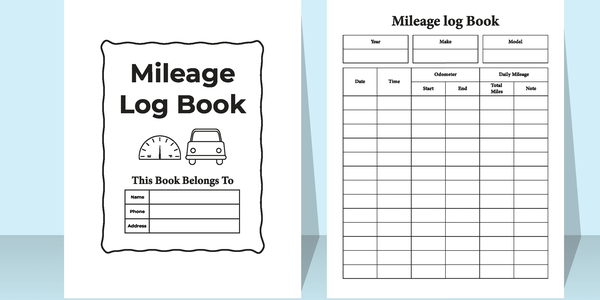

Your logbook must also show details of each business trip. You must write down:

- The date the journey began and the date it ended

- The car’s odometer readings at the start and end of the journey

- How many kilometres the car travelled on the journey, and

- The reason for the journey.

The logbook entries must be made at the end of the journey, or as soon as possible afterwards, and they must be in English. Your records must also show the make, model, engine capacity and registration number of the car. Note – you do not have to complete any private travel trips in the car.

You can purchase car log books from service stations or Officeworks. You can also use an App on your phonesuch as the ATO tool – MyDeductions

To download the App: My Deductions